We have just completed Q1 2024 Market Highlights of the top markets in Miami. This research focuses on properties valued at $1 million and higher. The purpose of this study is to help you understand the dynamics of Miami’s different markets compared to the previous year and get an insight into Miami’s performance and trends. When considering an investment in Miami’s real estate, the best decision is always a result of the best information.

The talent and wealth migration of people to Miami remains steady, contributing to a consistent upward trajectory in the single-family home market, realigning prices post pandemic surge to a new normal and establishing new price tiers. Although there have been decreases in the prices of condos in specific segments, these declines are not indicative of a significant softening but rather a gradual stabilization at considerable higher levels than pre-Covid circumstances. It is astonishing to consider that just six years ago, the average sales price for properties in the Brickell area exceeding $1 million would now stand at $1.7 million.

Entirely new price tiers have emerged due to highest asset class buying $40M+ plus properties. For the 1st time ever, there are over 25 listings at $40M and higher. There was only 1 during the same period of 2023.

Some of the standouts of the Q1 2024 highlights include:

- Coconut Grove pricing for both homes and condos continued its surge. A particular condo, which we had the privilege of selling, set a new benchmark at $3,295/SF, surpassing all previous condo records

- Coral Gables’ homes thresholds increased over previous year as did Miami Beach homes

- The average sales prices for condominiums in Surfside have reached unprecedented levels of $10M, primarily driven by the significant sales of high-priced units at the Surf Club Four Seasons

- In some markets, we have witnessed a decline of closed transactions as inventory levels have increased

- Average sales per square foot for $1M+ condos have slipped in some markets

If you require research on a particular market or if you would like more specific information on a specific market or area (such as the performance of single-family homes in Palm Island Miami Beach compared to Q1 2023), or if you need forecasts or projections for Miami in Q2 2024, please reach out to us. We will provide you with a customized analysis within 24 hours, guaranteed. We will have the tailored highlight to you in less than 24 hours. Guaranteed.

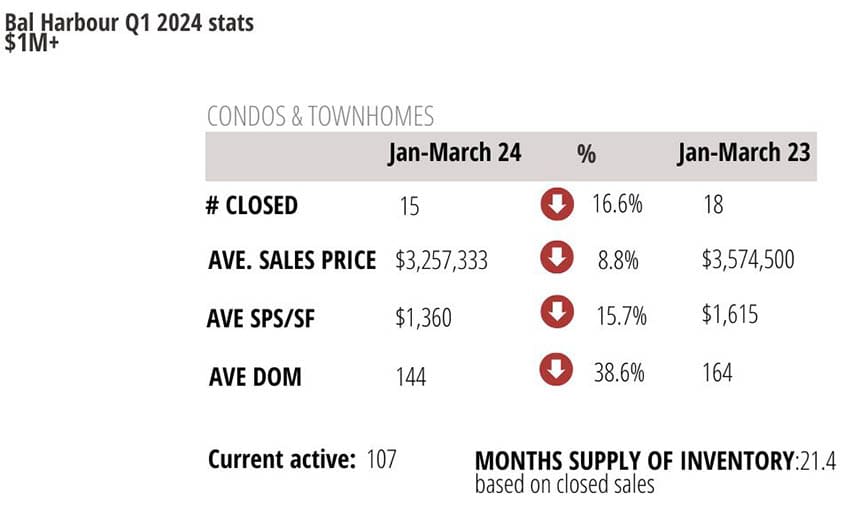

Bal Harbour Condos

- Condos have settled into a high entry $1M barrier, with average sold price at $3.2M.

- Selling at 8.8% less than last year’s period.

- Condos are trading at a brisker rate with days on market dropping 39%

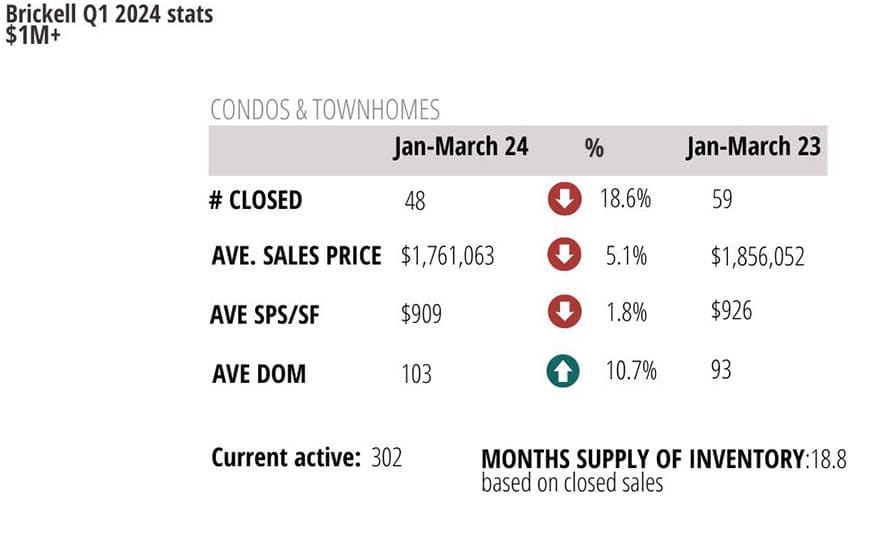

Brickell Condos

- The $1M threshold is at an average of $1.76M

- The average size sold is 1,932 sf with buyers searching for bigger spaces

- Average sales per square foot for all condos slipped by 5%

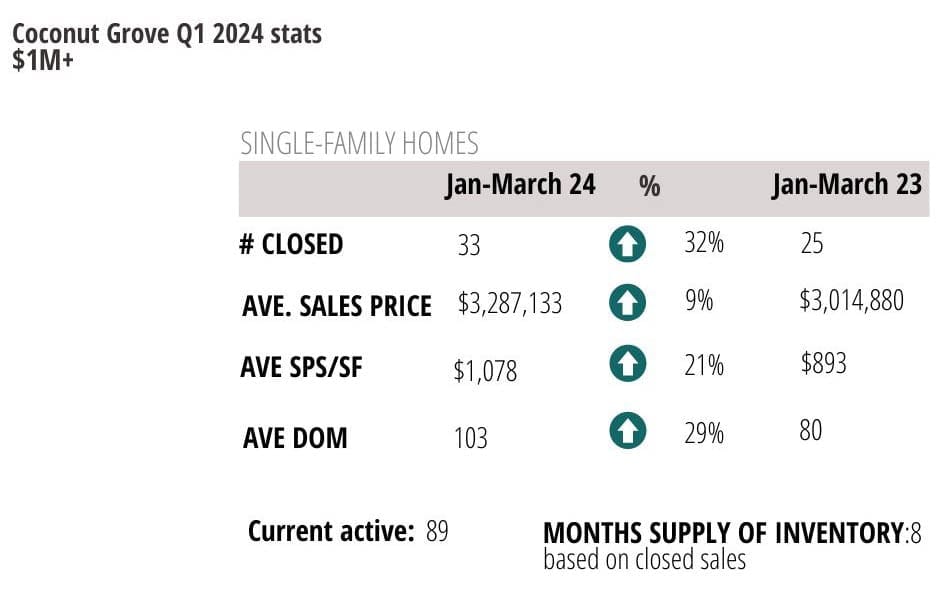

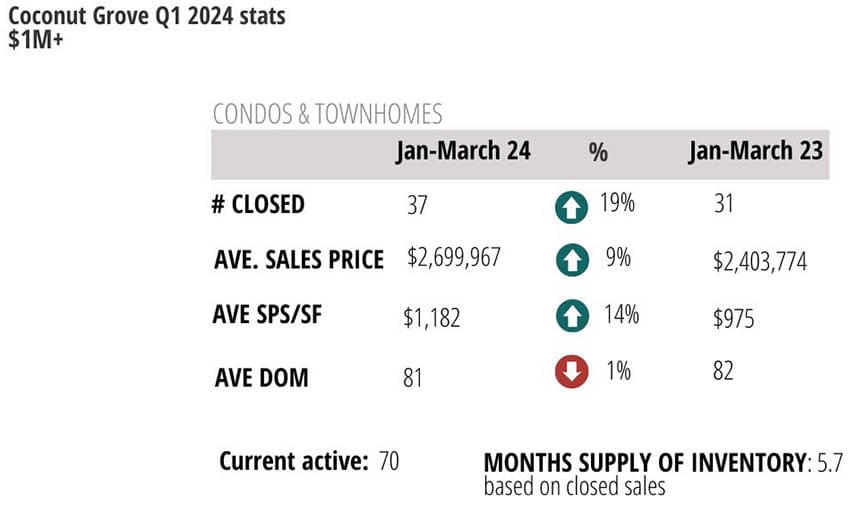

Coconut Grove

- Coconut Grove is one of the areas with the highest rate of price gains

- Number of closed transactions for homes and condos increased from Y-O-Y

- The highest sale per square foot for a Coconut Grove condo ever closed at $3,295/SF (off market sale by THE APT TEAM a One Park Grove)

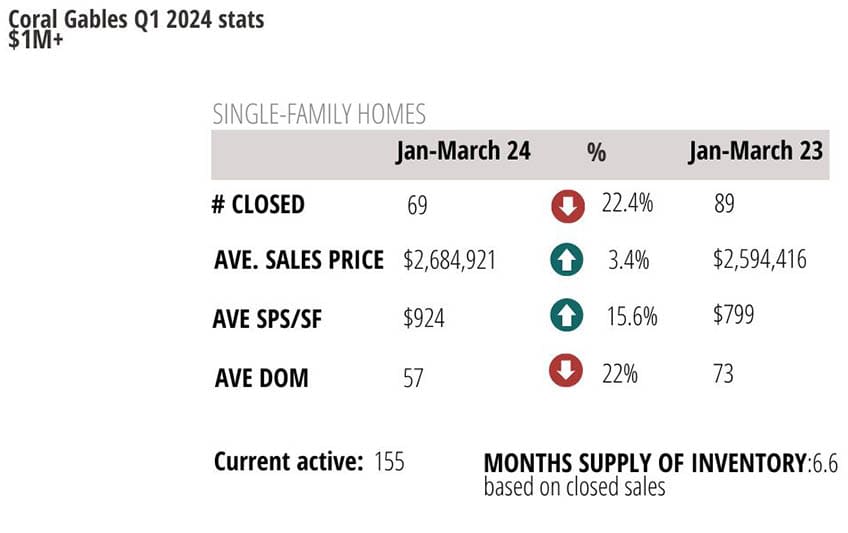

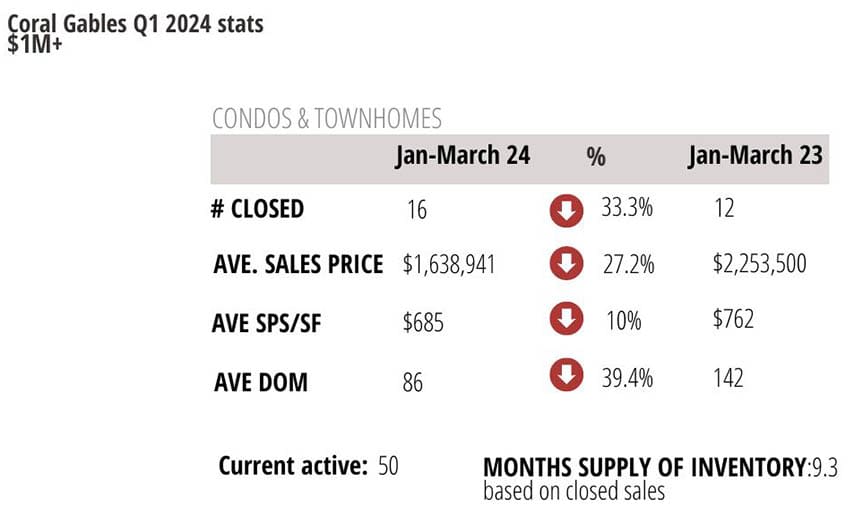

Coral Gables

- Sales price per square foot for single-family homes has moved to newer tiers, increasing 15% from previous year

- Days on market for homes has declined by 22%

- Increased condo inventory brought gains in number sold by 33% while adding pressure to sold prices

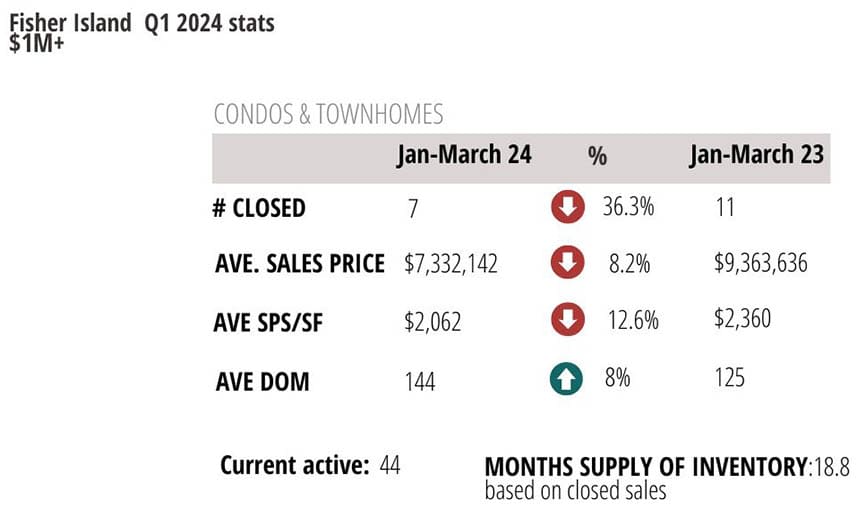

Fisher Island

- As wealthy buyers flocked to the island, property prices skyrocketed to levels never seen before

- The prices have now stabilized at record highs, with an average of $7.3 million

- The number of completed sales has decreased by 36%

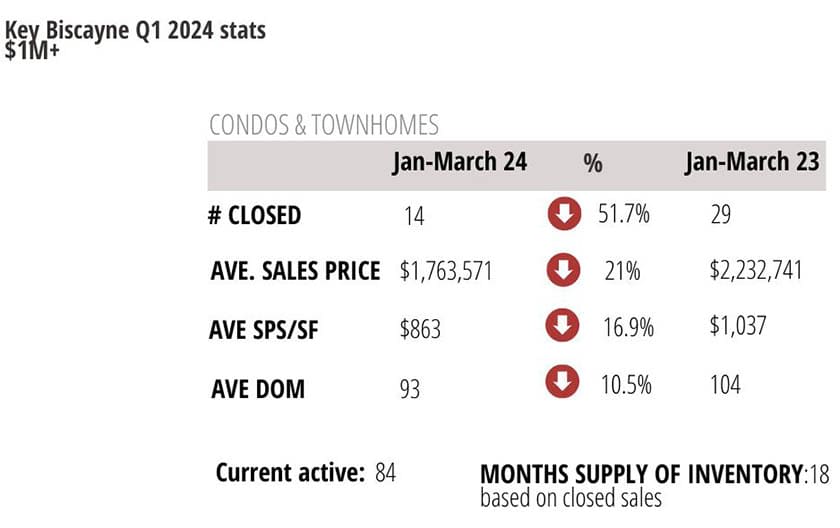

Key Biscayne

- The average sales price per square foot for homes has increased by 27% despite the average prices stabilizing

- Speed of market for homes and condos slowed with days on the market down by 48% and 10% respectively

- Condo inventory rise has put downward pressure in both sold transactions and the prices at which they are sold

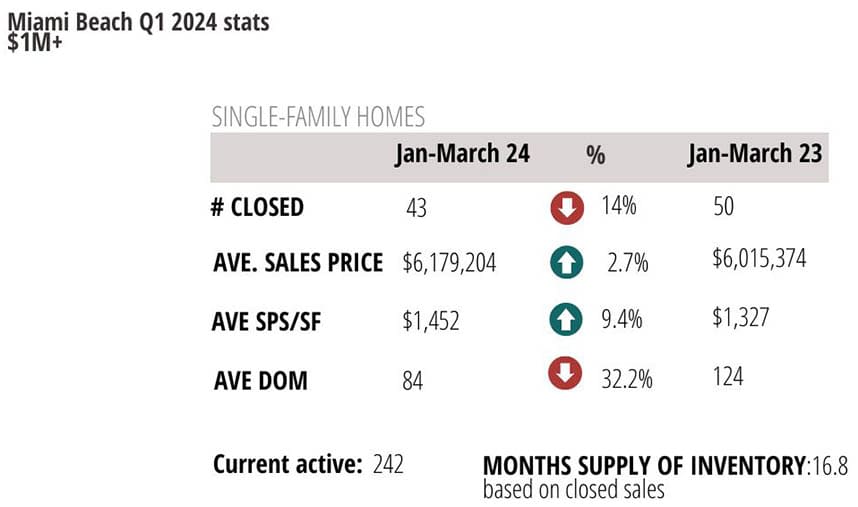

Miami Beach

- Average sales price for homes edged previous year's by 2.7%

- Demand for larger homes drove prices per square foot upward by 9% while condos sold attained an increase of 3% per square footage for smaller sizes sold

- Days on market for condos expanded by 11%

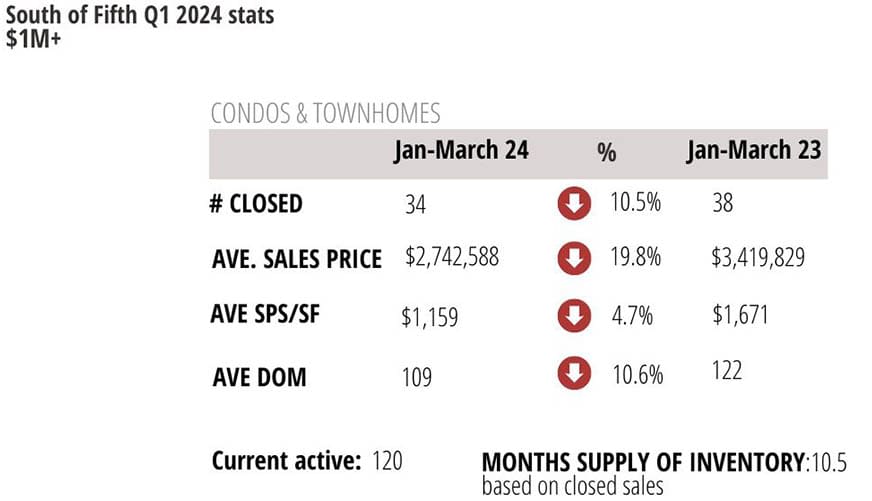

South of Fifth

- Condo average sales price has decreased by 19% compared to the previous period

- However, SoFi condos have consistently maintained higher prices than most areas in Miami with Ave. sales price of $2.7M, even before the pandemic boom years

- The pace of the market is not as rapid, as there has been a 10% increase in the number of days properties stay on the market

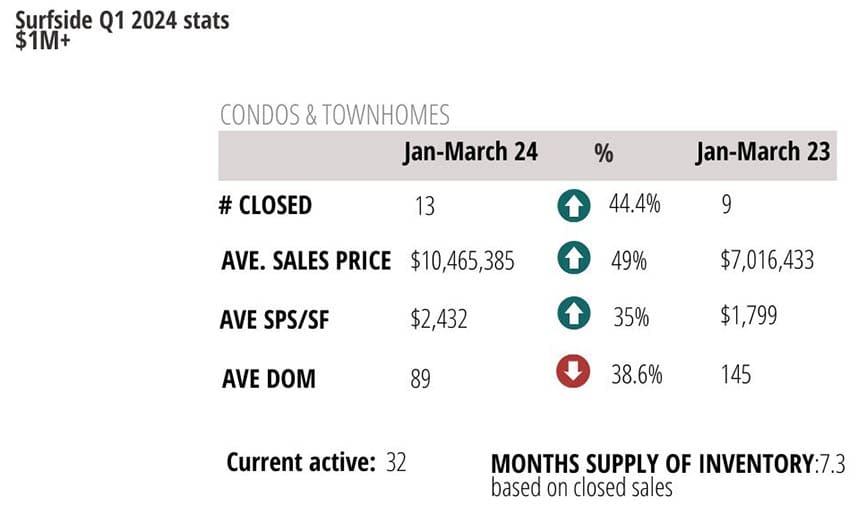

Surfside

- Average sale prices have reached further record-breaking levels, nearing $10.5 million

- This surge can continue to be attributed to the substantial numbers achieved by Surf Club Four Seasons sales

- Thresholds have been pushed even higher due to an increase in the number of condos sold and a significant drop in the average days on the market, which has decreased by 39%

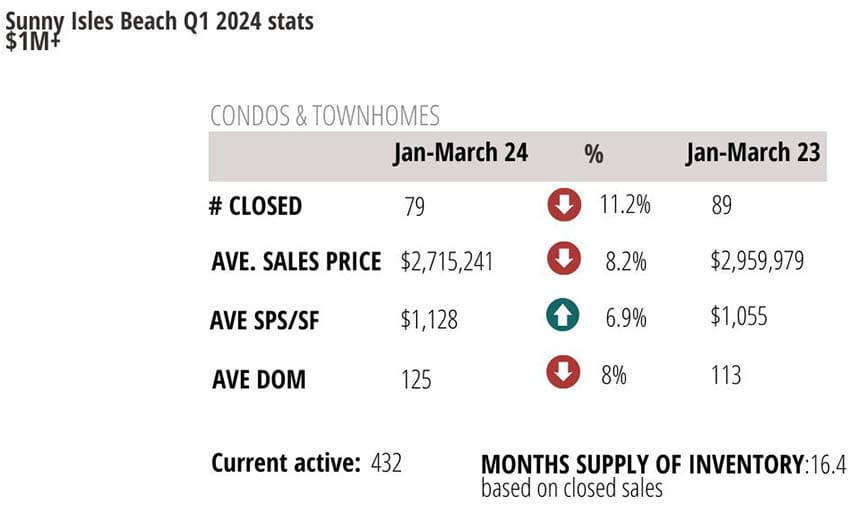

Sunny Isles Beach

- The process of selling condos/townhomes has become faster, as the number of days it takes to sell one has decreased by 8%

- The average sales price has stabilized at $2.7 million, experiencing an 8.26% year-on-year drop

- Average sales price per square foot increased by nearly 7%

This APT Market study was compiled from data obtained from the MLS. It was made with information of sales from January 1 through March 31, 2024 included comp only MLS sales. The information contained herein is deemed accurate, but can’t be relied upon. We are not responsible or liable for input, calculation errors and/or errors of omissions and market changes. We always advise those who wish to utilize this data to corroborate such information for themselves. Equal Housing Opportunity.

Tags

#miamirealestatemarket #coconutgrove #miamibeach #coralgableshomesforsales #surfclubfourseasons #fourseasons #miamibeachhomes #miamibeachcondos #oneparkgrove #fourseasonscoconutgrove #miamihomesforsale